Quick Go-through:

●Theft, fire, and water damage in warehouses make it essential for warehouses to have insurance.

●Free Trade Zones are more vulnerable compared to other parts of Dubai.

● One policy may not be enough to cover everything, and businesses may need multiple insurance types to stay fully protected.

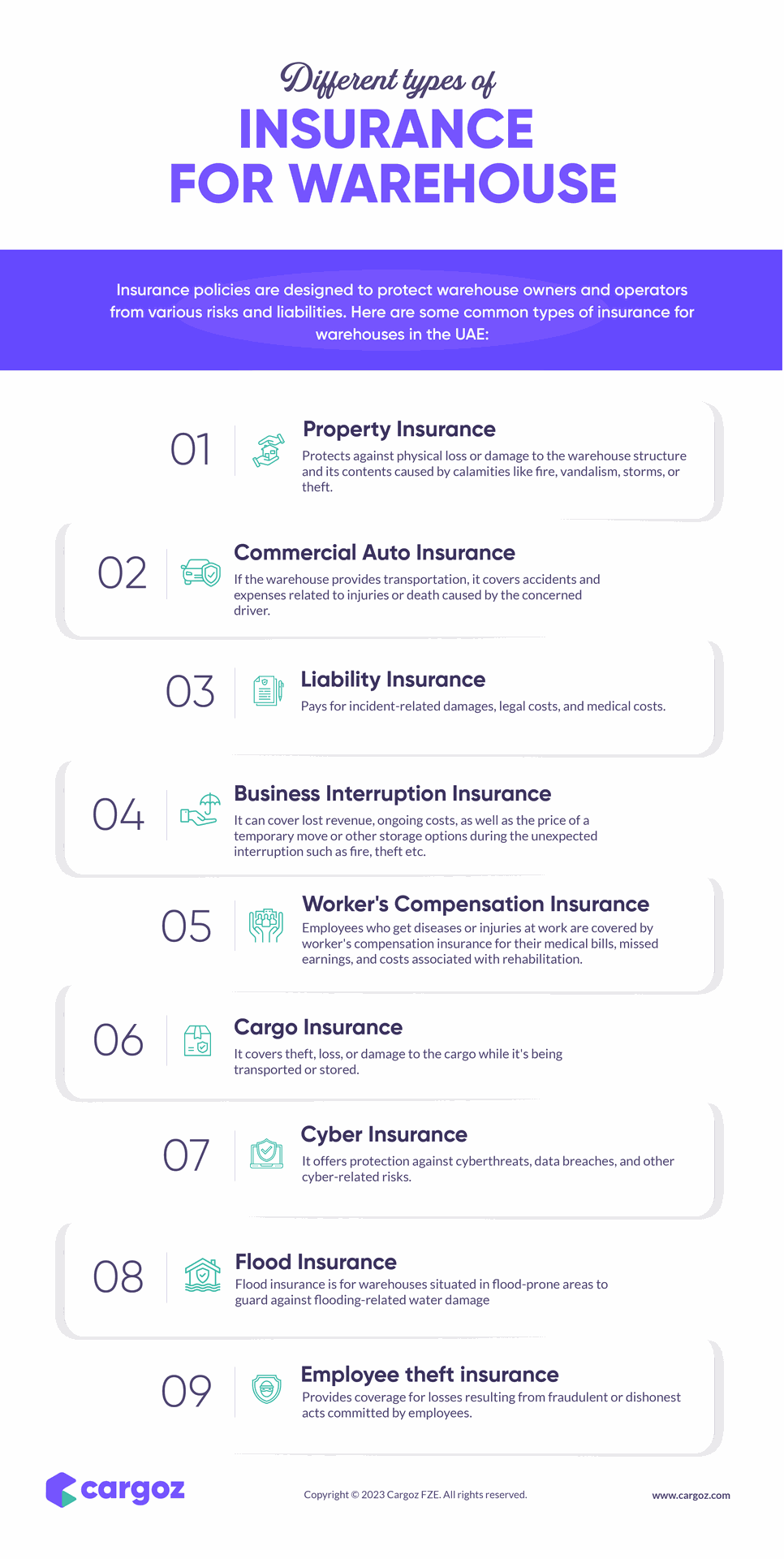

●Top insurance types include property, liability, business interruption, cyber, and employee theft insurance etc.

●Cargoz can help you find secure, insured warehouses in the UAE tailored to your inventory types and operational needs.

Theft and accidents cause massive losses to businesses that use warehouses. According to a TT Club report, 76% of cargo theft cases occur in warehouses, with Free Trade Zones (FTZs) being major hotspots.

Besides theft and accidents, warehouses also face challenges such as fire, natural disasters, equipment failure, inventory spoilage, workplace injuries, and cyber threats. This makes it essential for companies to cover their businesses with insurance.

But do you know that one insurance may not cover everything, and you may need to purchase multiple policies? This blog will explain the different types of insurance for warehouses, helping you understand which ones are essential for your business.

Table of Contents |

●What are the Various Types of Insurance for Warehouses? ●What Are the Factors to Consider When Choosing Insurance for Your Business? ● Final Thought ● Frequently Asked Questions |

What are the Various Types of Insurance for Warehouses?

Warehousing operations involve risks like fire, theft, property damage, and business disruptions. Here are the nine most important types of warehouse insurance businesses should consider:

1. Property Insurance

This type of insurance for warehouses covers the physical structure of the warehouse and any fixed installations such as office fittings, racking systems, or mezzanine floors. This is crucial for businesses that rent a warehouse and bear maintenance responsibility.

What It Covers:

● Protects against damages caused by fire, flood, explosion, vandalism, or other natural or man-made disasters.

● It usually includes the cost of repairs, restoration, or rebuilding.

2. Commercial Auto Insurance

Commercial auto insurance is essential for businesses that operate commercial vehicles for deliveries, pickups, or internal transportation. It protects your business from expenses related to accidents involving company vehicles.

What it covers:

● Injuries or fatalities caused by warehouse-owned vehicles.

● Property damage and medical/legal costs from vehicle accidents.

3. General Liability Insurance

General liability insurance provides coverage for legal claims that come from third-party injuries or property damage that occur on warehouse premises. It is essential for businesses with frequent on-site footfall.

What It Covers:

● Includes incidents involving delivery partners, visitors, or service contractors.

● Covers legal defense costs, settlements, or medical expenses.

4. Business Interruption Insurance

This type of insurance helps businesses to compensate for lost sales, rent payments, salaries, and operational costs during the downtime. It is critical for maintaining business continuity.

What It Covers:

● Covers the loss of income and ongoing expenses if your warehouse operations are halted due to an insured event such as a fire or flood.

● Often bundled with property or fire insurance as part of a comprehensive risk management policy.

5. Workers' Compensation Insurance

Workers' compensation is essential for companies in the UAE, especially those operating in the Free Zones. According to Federal Decree-Law No. 33 of 2021, employers are required to provide coverage for medical care, lost wages, and compensation in the event of a work-related injury, disability, or death. This is recommended for warehouse environments that involve manual labor or the handling of equipment.

What it covers:

● Medical expenses and wage replacement for injured employees.

● It provides compensation for permanent disability or death due to work-related accidents.

6. Cargo Insurance

Warehouse theft is a major problem for businesses across the globe, including the Middle East region. That’s why insurance for stock in warehouses and strict security measures are essential, especially for warehouses storing high-value items such as electronics, branded merchandise, or pharmaceuticals.

What it covers:

● It can cover both inventory and equipment loss due to forced entry, break-ins, or employee dishonesty.

● Often offered as an add-on to broader property or inventory policies.

7. Cyber Insurance

Smart warehouses are increasingly adopting digital systems, such as Warehouse Management Software, IoT, and cloud-based inventory management tools, and they become vulnerable to cyberattacks.

A single data breach or ransomware attack can disrupt your supply chain and compromise sensitive information. Cyber insurance helps businesses cover the financial losses from such threats.

What it covers:

● Loss related to data breaches, ransomware attacks, or business data compromise.

● Legal fees, notification expenses, and system recovery.

8. Flood Insurance

Flood insurance is a must for warehouses located in flood-prone or coastal regions. It protects against losses caused by waterlogging, which is typically not covered by standard property insurance.

What it covers:

● Damage to the warehouse structure and infrastructure due to flooding.

● Loss or damage of inventory and equipment caused by waterlogging.

9. Employee Theft Insurance

Many a time, even your employees may be involved in theft or malpractice. This insurance protects your warehouse business against financial losses resulting from theft committed by employees, including the theft of goods, cash, or sensitive data.

What it covers:

● Theft of inventory, materials, or cash by warehouse staff.

● Financial losses from employee fraud or forgery.

What Are the Factors to Consider When Choosing Insurance for Your Business?

Choosing the right insurance for warehouses helps you protect your business, assets, and reputation from unforeseen risks. But how do you choose the right ones for your business? Here are the key factors you must consider:

1. Nature of Goods Stored

The type of products you store, whether electronics, perishables, chemicals, or others, determines the level and type of coverage required. For example, businesses handling high-value goods may require enhanced protection against theft and fire.

2. Warehouse Location

Certain areas are more prone to risks like flooding, theft, or fire. For instance, Free Trade Zones (FTZs) in the UAE have higher reported cargo theft rates. So, evaluate local crime rates, environmental risks, and emergency response infrastructure when getting insurance.

Suggested Read: Why is location an important factor when choosing a Warehouse

3. Extent of Liability Exposure

When purchasing insurance, you should also think about your liability in case of injury to warehouse staff, damage to third-party goods, or non-compliance with lease terms. If you are renting a warehouse, review the rental agreement for tenant liability clauses.

4. Regulatory Compliance

Certain types of insurance coverage are mandatory for some locations and types of goods, and Non-compliance could result in penalties or business disruption. So, ensure your business is covered with insurance.

Final Thought

Warehouse insurance protects businesses from significant loss and helps to recover damages quickly. With threats such as cyber risks, equipment failure, and liability claims, relying on minimal coverage can expose your business to significant losses.

At Cargoz, we work with a diverse network of warehouse providers across the UAE. Almost every warehouse listed on our platform adheres to industry best practices regarding safety, compliance, and risk mitigation.

Whether you are looking for a flexible short-term warehouse or a long-term rental option, we provide the best fit that suits your needs. Contact us to discuss your warehousing needs.

Frequently Asked Questions

1. Why is insurance essential for businesses owning or renting a warehouse?

Insurance protects your business from financial losses due to theft, damage, liability claims, or operational disruptions in owned or rented warehouse spaces.

2. Can I bundle multiple types of warehouse insurance together?

Yes, many insurers offer bundled policies for warehouses, including property, liability, cyber, and equipment breakdown coverage under a single policy to simplify management and reduce costs.

3. What is not covered by standard warehouse insurance policies?

Standard warehouse insurance may not cover natural disasters (unless specifically added), employee theft, wear and tear, and certain types of cybercrime, or may only be covered under specialized policies.

4. Does Cargoz provide warehouses for high-risk inventory like electronics or perishables?

Yes, the Cargoz platform offers a wide range of warehouses for fragile, high-value, or sensitive goods. You can discuss your requirements, and we will help you with the right warehouse.

5. Does Cargoz verify whether listed warehouses have insurance coverage?

Cargoz verifies warehouses based on operational quality, security measures, and facility standards. However, we recommend you discuss specific insurance coverage when renting.